Make significant tax savings with life and protection insurance

DID YOU KNOW?

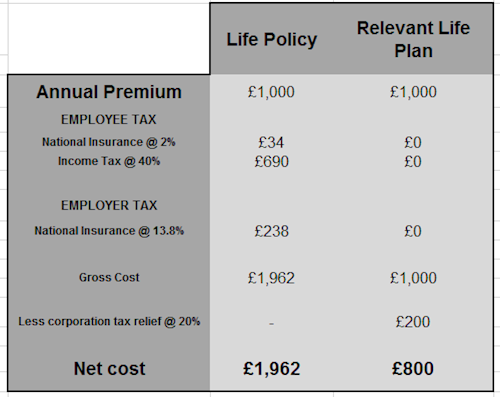

You can make significant tax savings when you take out a Relevant Life Policy compared to an ordinary Life Policy.

Relevant Life Policies are a tax efficient and cost effective alternative, or ‘top up’, to group death in services benefit, both for company directors and employees.

With a Relevant Life policy the business makes the payments, not the person who’s insured. That means you won’t pay any national insurance contributions or income tax on the premium but you still get the benefits of corporation tax relief.

See how the Relevant Life Plan can save you substantially each year:

Source: *Assumes that corporation tax relief at 20% has been granted under the ‘wholly and exclusively’ rules. In both cases we’ve assumed a payment of £1,000 each year for the life cover on an employee who’s paying income tax at 40% and employee’s National Insurance at 2% on the top end of income. We’ve also assumed that the employer is paying corporation tax at the small profits rate of 20% and will pay employer’s National Insurance at the contracted-in rate of 13.8%

To find the best way to protect you and your family, talk to us today on either 01371 877966 or email protection@saffroninsurance.co.uk

Tags: tax | lifeandprotection | employee | employer